An Ode to Frittatas

If you could design the perfect food, what characteristics would it have?

- Inexpensive

- Healthy – plenty of vitamins, minerals, protein

- Delicious

- Easy to cook and forgiving to mistakes

- Can be made in large batches and stored in portions for later easily

- Flexible with ingredients – can be made with whatever you like and have on hand.

- Can be made with a single pan and is easy to clean up.

- Doesn’t take long to cook.

There is such a food and its name is frittata.

Start by cooking whatever vegetables and meat you like in a large pan to about 75% doneness. Add enough scrambled eggs and shredded cheese to cover them and cook until the bottom is browned. Either flip and continue cooking or bake at 350 until the eggs have solidified. And that’s it. Of all the foods in the world, I would say this is the best one for amateur cooks to try.

The World is Failing at Morality

Would you endure nausea to save a life? Would you endure pain to save a life? Unless you’re a sociopath, you would answer “yes” to these questions. Why then are people unwilling to endure moral discomfort to save a life? There are many moral situations where the right choice from a utilitarian perspective feels “yucky” to some people, but I don’t think there is any real difference between enduring moral discomfort to do the right thing and enduring other sorts of discomforts to achieve good outcomes.

Suppose there were a group of 9 fundamentalist Christians and one atheist in the arctic and because of some accident there were only nine pure wool coats and one coat of mixed fabric. If the mixed fabric coat was unused, one person would freeze to death. Should the group allow the atheist to wear the mixed fabric coat? The Christians would likely feel moral discomfort about being in the presence of someone wearing mixed fabric, but if doing so saved a life, I would argue it is worth doing.

Right now, our society is facing that dilemma with children and covid vaccines. Instead of Christian fundamentalists, we’re dealing with timid FDA bureaucrats. They aren’t really risk averse, since the riskiest option is to allow schools to reopen with unvaccinated children without protection. The riskiest option was to wait a year before approving effective and safe vaccines, which is the option they chose despite it causing massive losses of institutional trust in them. Tens, if not hundreds of thousands of Americans will die if no action is taken. Hundreds of thousands have already died. It’s one thing to say that parents should not be forced to give their children a vaccine, it’s quite another to say they should not be allowed to protect their children.

There is no evidence that the vaccine will cause side effects even in the same order of magnitude as getting covid. With the delta variant, we’re not choosing between getting a vaccine or getting nothing, it’s between getting covid with the vaccine or without. Delta is contagious enough that everyone will get it sooner or later. Even if children themselves don’t die of the disease, they will spread it to others who will die. It seems to me that this wave will be even worse than the winter wave of December 2020/ January 2021.

Giving children experimental vaccines is only one area where “risk aversion” is actually the riskiest choice from a society’s perspective. Challenge trials are another. Let healthy volunteers infect themselves with the virus to actually remove all the ambiguity of the effectiveness of the vaccine. Yes, some may suffer serious consequences, but as a society, we will save lives. People had no qualms about sacrificing thousands of lives in needless wars, but somehow getting a thousand people sick to save millions is beyond the pale?

The FDA be far more bold. Allow anyone who wants to try a drug for themselves do so after signing a waiver. Do safety only testing and let the self experimenters provide data on effectiveness themselves. Use data from foreign countries to determine safety. There’s no reason to disregard an experiment just because it took place across a political border. Imagine if each state had to do their own safety testing and we pretended like a test in Virginia was somehow completely inapplicable in Wisconsin. We literally do the exact same thing with tests in Canada or Germany. Lastly, the level of resources spent on prevention/vaccines are tiny relative to other societal goals – there are more dead from covid than all military deaths in the history of America combined, yet the government has spent less on covid than military even in a single year. We should have dumped hundreds of billions out the door to get every vaccine maker into overdrive to vaccinate the world instead of dithering over a million here or there.

This past year and a half has been frustrating, stressful, and difficult for almost everyone. I am thankful no one I know personally has died of covid, but even so, hundreds of thousands of Americans died needlessly. There’s been so much selfishness and carelessness on display, but also much bravery and sacrifice. I hope that we will learn some difficult lessons from this tragedy.

Revisiting Chrono Trigger

Intro/rambling: Chrono Trigger is one of the most beloved video games from my childhood – one of the many Square titles of the 1990s that I simply could not pull myself away from. Recently, I have been moving away from playing games such as World of Tanks, Warships, War Thunder, Warframe, and Minecraft, that I can sink thousands of hours into, and begun playing games for 20-50 hours and then moving on to a new one. I think it is a more enjoyable mode of playing, but it requires I find a new game at least once a month. I’ve burned myself out on Stardew Valley after about 500 hours (excellent game, btw – highly recommend), so I decided to go back to an old favorite I hadn’t touched in 20 years.

I was shocked at how short it was. It only took me a bit over 18 hours to beat without new game plus and even if one were doing a completionist approach, I don’t think there’s 40 hours of game play there. Compared to more modern RPGs, that’s surprisingly short, but during those 18 hours, the game feels expansive. You’re constantly going from time period to time period, meeting new characters, learning new skills, etc. The dialogue is solid and the characters feel relatable even if they’re a bit tropey.

The artwork and graphics are outstanding for the era they were released in and time and care is taken to maximize the visual appeal of the limited hardware they had to work with. Characters look stylish and cool, enemies are varied and sprites are very expressive and entertaining. The music is outstanding and ranks among the best video game soundtracks of all time. I found myself humming various music throughout the day from the score, and not just Crono’s Theme or Corridors of Time, but even just the town music, or Undersea Palace, or whatever I had just played. At the Bottom of night is my favorite “sad” video game music of all time and is poignant and moving. You can find dozens of remixes and performances of these songs on YouTube and that stands as a testament to the staying power of such works that people are still remaking them even after over 20 years.

In terms of game play, combat is fairly dynamic, with a lot of special attacks and counter attacks triggered by various events. Many enemies have exceptionally high defenses to various attack types, so you can’t just brainlessly mash the attack button and expect to do as well as someone who pairs the correct attacks to the particular enemy. Chrono Trigger had many innovative features such as New Game + where you could restart the game keeping your old levels and equipment, multiple endings, and combo attacks using two or three characters to perform special attacks together simultaneously. It’s not a particularly challenging game, but there are tricky parts throughout the whole game from beginning to end.

I think the biggest lesson there is for modern game developers in Chrono Trigger is that your game doesn’t have to be particularly long to be memorable. It’s better to make a 20 hour game that is fun the entire time than add 100 hours of boring grind to pad it out. Maybe that’s thought of as outdated these days, but I think with the flood of mediocre games out there vying for attention, it wouldn’t hurt to make the best 10 hours of game play you can first and then worry about padding it out later.

Super Easy Chili Recipe

- Get a pot and coat the bottom with oil

2. Add 1 bag of frozen onions and peppers, or 1 onion and 2 peppers. If you use frozen vegetables, cook on high until melted, then reduce to medium before continuing.

3. Add 1 lbs of ground beef, or lamb or other meat substitute.

4. Add 1/4 cup of chili powder, 1 tbsp of cumin and 1 tbsp of garlic salt. Add hot sauce and other spices to taste.

5. Cook on medium high heat for 15 minutes until most of the moisture is boiled off and you get a bit of browning.

6. Add a can of tomatoes and a can of beans. The beans are mandatory. Chili without beans is just beef soup.

7. Reduce heat to low and simmer for 30 minutes.

Veganism, Alcoholism, and Quarantine

There is a phenomenon where if one person engages in some morally good action that is above and beyond the societal norms of their group, they are resented by others because the action is a (mild) condemnation of everyone who does not also do it. Morality is judged by the dynamics of the group. If everyone does something, everyone else is expected to do it as well. Slacking is not acceptable because well, if everyone else is doing it, why can’t you?

- Alcoholics will resent and try to sabotage friends who quit alcohol. Frequently it is better for the recovering alcoholic to just cut ties with all of the alcoholics in their life for this reason.

- Obese people who try to lose weight will often be criticized by their other obese friends and have them criticize their new lifestyle with insincere concern trolling: “All that exercise isn’t good for you.”, “your brain needs at least 900 g of refined sugar per day to survive”, “you’ll go into starvation mode if you lose so much”, etc.

- Vegans are often ridiculed and ostracized for being committed to their moral beliefs to the detriment of eating delicious food and following a very strict diet.

- Hard workers at a company, especially new hires, often attract resentment from less hard working employees. There may be good reasons for this such as rushing poor quality work, or working at an unmaintainable pace, but I think for the most part it’s just resentment for putting more effort in than others and the group wanting to maintain a lower standard. You can maintain a breakneck pace for a month or two, but after several years, you’re not going to want to give the company 100%.

- Quarantining from the pandemic is hard and it puts strains on social relationships. If one person either doesn’t believe that the disease is a large threat, or other differences in value judgements, avoiding social interaction can be misconstrued as not valuing a relationship as well as an attack on their beliefs and the condemnation that they are not doing as much for society as you are.

- Trumpism – I think a large reason why the “deplorables” crowd supported Trump is because he puts no moral demands on them. If the president commits crimes, cheats on his wife/taxes, lies, condones violence, is racist etc. then it’s ok for you to do the same too.

I don’t know what to do about all this. If you’re going to go the extra moral mile, sometimes it’s worth trying to evangelize others. By shifting other people’s opinions of what the average person does, you can improve their moral actions. In other situations, it’s better to keep things to yourself to avoid their disapproval, but this phenomenon is a strange quirk of human nature.

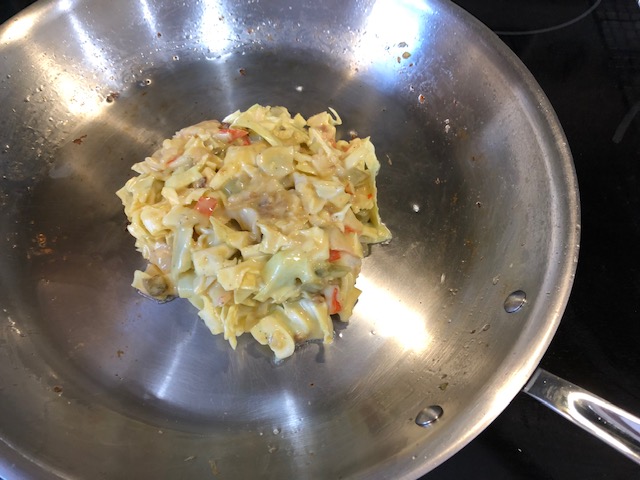

Americanized Okonomiyaki

Okonomiyaki is delicious, healthy, and easy to make. However, there are many ingredients that are hard to find in America, so this version only has stuff you can easily get in a normal grocery store. It won’t taste as good as a real authentic recipe, but it’s better than nothing.

Step 1: Mix 2 cups flour, 6 eggs and 1/2 a cup of milk (or water) and whisk together until it forms a batter.

Step 2: Finely chop 1/2 a small cabbage or 1/4 of a large cabbage and add to the batter, mixing together until cabbage is coated.

Step 3: Add whatever meat and vegetables you want. Partially cook any meat you add because it won’t cook all the way in the pan. It’s common to top the okonomiyaki with bacon (or pork belly if you’ve got it), but this is optional.

Be aware of your batter/filling mixture. If it comes apart in the frying pan, you had too little batter. If it is very cohesive and not falling apart at all, you can add more meat/vegetables. You want it to almost fall apart, but not quite.

Step 4: Preheat a layer of oil until it is shimmering. This is important since if you add the batter to a cold pan, it will stick and be hard to flip. Once the pan is hot, add a large dollop of mixture to the center and smush it down until it is 1.5 inches thick. It should not take up more than half the pan’s area. Pan fry the mixture at medium/low heat until brown. Flip over halfway and cook other side.

Step 5: Salt to taste. Top with BBQ sauce, a drizzle of mayo, any whatever else you like like green onions or dried seaweed (shown above).

Okonomiyaki sauce: 4 tbsp ketchup, 3 tbsp worchestershire sauce, 2 tbsp soy sauce (or oyster sauce if you have it), 1 tbsp honey, sugar, or molasses. Mix together thoroughly. You can skip this step and use regular barbecue sauce as well.

If you could only eat 10 foods

What would they be and why? It can be any 10, but hypothetically you’d have to live an extended period with nothing else. This includes dealing with any nutritional deficiencies caused by such a diet. You can use the ingredients to make other things. You get water for free.

I’m going for variety and health mostly. Two vegetables (one leafy, one cruciferous), two fruits (one fatty, one berry), one nut, one mushroom, eggs, dairy, and one meat. Most people would want a starch as well, so potatoes or yams are an option.

1. Cauliflower – Contains many nutrients including vitamins C, K1, B9, potassium, manganese, iron, sulforaphanes, carotenoids, and other antioxidants. It is a very flexible food and can be mashed or riced to take the place of potatoes in many recipies, or even flattened out and baked into a pizza-like crust (altho not as good).

2. Wild Salmon – Salmon has tons of protein, omega-3 fats and vitamins A. B, and D. Salmon is rich in magnesium, potassium, phosphorus, zinc, calcium, and selenium. It’s my favorite fish.

3. Blueberries – Berries are very healthy and taste great. They have tons of antioxidants.

4. Eggs – Eggs are packed with various nutrients, especially from pasture raised chickens allowed to forage. They can easily be combined with the other ingredients in various ways and are delicious.

5. Shiitake Mushrooms – Mushrooms have a lot of trace minerals and add more variety. I really like the chewiness and flavor of the shiitake.

6. Walnuts – My favorite nut and are rich in omega 3s.

7. Seaweed – Very nutritious and can be dried for a good low calorie snack. Pairs well with salmon.

8. Olives – I’ve got good sources of omega 3s, but olives add a good source of omega 9 and monounsaturated fat. I’d also need some type of oil to cook everything else on this list in and I could press the olives for oil.

9. Potatoes – Very versatile starch, healthier than wheat or rice.

10. Milk – Contains a lot of nutrients, and you could make cheese, yogurt, butter, and cream as well. Since it’s my blog post, and I’m making the rules, milk is the only “food” in cheese so cultures, rennet, and calcium chloride don’t count as part of the 10 choices.

Related Links:

Defunding police?

“Defund the police” is a terrible slogan and would be counter-productive policy. According to the concept of compensating differentials, if you make a job more difficult, you will have to pay more to attract workers. Holding police to a higher standard and getting the sorts of people who we want to be police to be willing to work will require paying them more. Trying to improve any governmental service by lowering the amount we pay for that service is counterproductive, and there’s nothing about police work that would suggest it is an exception. If budgets and pay are cut, don’t be surprised when the only people who still want to be cops are those who think the biggest perk is getting to beat people up and break the law with impunity. Qualified immunity should not be a job perk, let alone a major one.

The police do too much. They are not equipped to handle many of the things they are asked to do, such as dealing with mental health issue and animal control. There’s no reason why the same group that handles traffic tickets should be solving murders. There should be separate unarmed social workers who deal with non-violent disputes and mental health issues should be dealt with by specialists. These new departments will all cost money to operate, but they are worth the price for improved public safety.

Ending the War on Drugs should be the absolute #1 priority for anyone looking to reform the police. Throwing someone in prison for drug use does not help them, it does not help anyone else, it does not reduce the rate drug use, it make recovery from addiction more difficult, and prohibition increases secondary crime. Drug enforcement creates the mentality that anyone can be a criminal. If you take a completely normal person going about their day, not bothering anyway, but they’ve got a joint in their pocket, now all of a sudden, they are a criminal. Something like 70% of Americans have tried pot, and 22% are regular users. That means if police were doing their jobs perfectly, 77 million Americans would be behind bars.

The mentality of “everyone is a criminal” is a cancer in policing. Police see everyone who is not a police officer themselves as a potential enemy and since drug dealers are often well armed and violent, the drug war makes police more likely to be shot and thus more afraid of being shot. The 4th amendment, the 5th amendment, due process, the Takings clause, every other value and principle society holds dear is sacrificed to the all consuming goal of continuing the drug war. Without the drug war, all of that goes away. Police could focus on victimed crime. People who are victims of crime could go to the police asking for help, instead of having police out looking for trouble.

There should be a fee for calling the police over a non-crime to discourage nuisance police calls. If police get called and there is no law broken, maybe the caller could pay a hundred dollars or so for bothering the police. This would discourage people from calling the police over every little thing. Police/civilian interaction should be minimized to avoid police shootings.

Studies have shown that for discouraging crime, the odds of getting caught are far more important than the harshness of the punishment. A well functioning society does need police to catch criminals, but it doesn’t need to throw those criminals behind bars for years to discourage them. Non-violent crime punishment should focus on reforming criminals and doing community service. Having more police investigating things like shoplifting, bicycle theft, petty property destruction and things like that would do more to help society than having an equivalent amount of money spent on prisons extending the sentence of someone caught for said crimes from 1 year to 5 years.

By the time a criminal comes out of prison from a 10 year sentence, that is the only life they know. They are cut off from getting a job. They have no friends or family to support them. Most of the time, they go right back to a life of crime. The Scandinavian countries show that reform minded policies are far more effective for lowering the crime rate than lengthy prison sentences.

It might be cathartic to shout “abolish the police” and “ACAB”, but at the end of the day, we need to live in the society we create for ourselves. You can’t have a breakdown of (real) law and order. People need to go to their jobs, buy groceries, take care of their families, and get on with their lives and without police, none of that can happen with any assurance of safety. Having said that, when police are allowed to commit crimes with impunity, they undermine the trust of society and likewise destroy societal order. Conservatives pretend that having cops act like the mafia, dealing drugs, killing, raping, etc. is “Law and Order”, but nothing could be further from the truth. We need to hold cops to at least the same standards we hold everyone else to, and right now, their standards are far lower.

Related Links:

Best Crops in Stardew Valley

This guide is for 2nd+ playthroughs. If you’re brand new to the game, I recommend playing the first year just exploring and trying out whatever you like. Stardew Valley has no time limits and there’s no reward for rushing through the game as quickly as possible. Having said that, here’s my guide to rushing through the game as quickly as possible.

General Advice

The best overall late game crop is ancient fruit, plus some starfruit for aged wine. Processing crops in kegs and preserves jars dramatically increases profitability, so make as many as you can. You can place them around town. There are two good types of crop: berries (strawberries, blueberries, and cranberries) and giant (cauliflower, melon, and pumpkin). Berries generate a large number of low value crops and earn the most profit when you sell them without processing. Berry seeds are expensive when bought from Pierre or Jojamart, but each berry can produce 1-3 seeds in the Seed Maker. Giant crops can be harvested twice per season and are high value, which is the best for turning into wine and juice. They also can turn into giant versions if planted in a 3×3 grid or larger, which yield 15-21 crops instead of the normal 9.

Year 1, Spring

The goal is to get strawberries at the Egg Festival on the 13th. You can harvest a round of potatoes on the 7th, and then plant parsnips in time to harvest them by the 13th. Since Pierre’s is closed for the festival, you do not have enough time to harvest and sell cauliflower or a 2nd round of potatoes in time to get money for strawberries. If it’s on or before the 5th, you have time for potatoes. If its the 6th or 7th, you have time for parsnips. If it’s after the 7th, just save your money for the Egg Festival.

Save some strawberries for the Seed Maker so you can start your second year Spring with strawberry planting on day 1. Plant cauliflower in any extra farm space you have left over after planting all your strawberries. Save a gold cauliflower for the Luau.

Other tips: Remember that when the seasons change, all of your plants die, so add the growing time to the date and make sure it’s 28 or lower before planting. Use the scythe to cut weeds so you can get free mixed seeds. Use any profits from fishing and mining to buy more seeds. Fishing is the best non-farming early game way to make money. You can eat the cheap fish or algae if you’re running low on energy. Use preserves jars as much as possible.

If you’re doing the Community Center, plant enough parsnips to get 5 gold ones for the quality crops bundle, and one green bean plant for the Spring Crops bundle.

Year 1, Summer

Blueberries make the most money if directly sold, but melons have higher base value and can become giant.

For the Community Center, also plant the following: hot pepper, 5 corn, sunflowers, poppy, tomato plant, and 2 spaces of wheat (7 harvests each during summer). If you have extra cash, get a pomegranate and/or apple tree.

Year 1, Fall

The three most profitable crops are:

Sweet gem berries – Seed cost is 1000 at the Traveling Cart and it sells for 3000 base yielding at least 2000 (more if higher quality). Sweet gem berries cannot be used in kegs.

Cranberries – Each plant produces 10 cranberries per season, earning 750 base profit. Seeds cost 240, yielding 490 base profit. Because they are multiple crops per harvest, it is harder to process cranberries than pumpkins. Since the seed price is high, using the seed maker to create more seeds is highly recommended.

Pumpkins – You can plant 2 rounds of pumpkins per season, earning 220 profit (320 sale price – 100 for the seeds) each time for a total of 440, before the giant crop bonus.

For bundles, plant a yam and eggplant as well. Corn, sunflower, and wheat should be completed in the summer, but if not, you can plant them now too.

Year 1, Winter

The only thing you can grow outside is Winter seeds. Save some winter seeds for planting next year. Use normal quality crops to produce seeds if you can.

Greenhouse Crops

There are 5 crops that are worthy of a coveted spot in a greenhouse.

Ancient fruit – The best endgame crop, both for kegs and for direct sale. If you’ve gotten an ancient seed, plant it here asap and turn the fruit you get into more seeds until the greenhouse is full. It is unlikely you’ll have enough ancient fruit year 1 though to fill a greenhouse.

Starfruit – The highest value base crop, which translates into the most valuable aged wine. Do not bother with starfruit if you’re planning on selling it.

If you don’t have ancient fruit or starfruit, there are 3 other good options, each with their own advantages.

Blueberries – The highest profit/day for direct sale of crops. Since they produce 3 berries with a base price of 50 each, they are a poor option for kegs, although you can make jam if you have enough preserves jars.

Strawberries – The same profit/day as cranberries, but they only produce 1 instead of 2, making them more manageable for processing into wine and jam.

Pumpkins – Lower profit per day and requires continual replanting, but since they only produce one crop every 13 days, they can be turned into juice quite easily.

A note about sweet gem berries: Although it might seem like these are a great option for the greenhouse, they cannot be processed in kegs. A sweet gem berry sells for 3000-4500, whereas starfruit wine sells for 3150. Since starfruit seeds can be bought for 400, whereas sweet gem berries seeds must either be bought one at a time for 1000 at the traveling cart or created in the seed maker, it is much more difficult to farm them in large numbers. On top of that, starfruit grows nearly twice as quickly.

The second best fruit trees for the greenhouse are peach and pomegranate. They are the same profitability and are universally liked gifts. Bananas are better, but are harder to get.

Year 2, Spring

Now we’re into the turbocharged part of the game. Whatever excess ancient fruit seeds you have that don’t fit in the greenhouse should be planted as quickly as possible. Any remaining crop space can be filled with strawberries. Since the crop bundles/Joja Mart bundles should be complete by now, you don’t need to worry about that and can just go for pure profit. Get iridium sprinklers and Junimo huts harvesting them for maximum automation. Rhubarb (purchased in the desert) is the best crop if you want to make wine, followed by cauliflower.

Year 2, Summer

Plant starfruit in the non-ancient fruit spaces. Save some starfruit wine for use in casks because it is the highest value iridium quality wine.

Year 2, Fall

Same as Summer, but with sweet gem berries, pumpkins, and cranberries instead of starfruit. Do not plant any ancient fruit this late in the year.

Year 2, Winter

You should have plenty of winter seeds from last year. Although this is a low value crop, every little bit helps.

If you follow this guide, you should earn 5,000,000 + by the end of the second year, enough to set up your farm however you like and get all the fancy buildings in Year 3, such as the Gold Clock and Warp Obelisks.

Ginger Island Crops

Pineapples are good, but inferior to Ancient Fruit. They have a higher base price (300) than melons, but only require 7 days to regrow compared to 12 for melons. For direct selling, it is superior to any berry. Taro Root is not a very profitable crop. My recommendation for Ginger Island is to grow as much ancient fruit as you can and with the leftover spaces, grow pineapples.

Crop planning tool:

https://exnil.github.io/crop_planner/

Modular Chow Recipe

This is mashed cauliflower, sour cream, cheese, onions, peppers, peas, and black beans with curry powder and garlic salt.

This is not a recipe so much as a class of recipes. Any or all of these ingredients can be added to a large pot and simmered. Any special preparation will be noted.

Starch/filler

Mashed Cauliflower – Cut off leaves and stem. Cut into 4 large chunks and steam for 12 minutes. Mash and add at the end.

Beans

Rice – 1 cup. Steam separately and add at the end.

Diced potatoes – Clean, dice and boil in salted water for 15 minutes before adding. I’m not sure about different varieties so you might need to look up other recipes.

Carrots – Chop and boil for 8 minutes

Corn – steamed or canned

Proteins

I recommend 1 lb of one of the following:

Tofu – Dice. You can fry in oil and spices separately to increase flavor, or just add it.

Beef – You’ll want to fry this separately to get some browning on the meat. I don’t recommend draining the fat since you’re losing calories and it’ll all mix in at the end.

Chicken – Dice and sear 5 min before adding.

Eggs – You can just crack and egg in the pot and stir it in.

Vegetables

Onion – Fry on medium heat for 20-25 minutes before adding

Peppers- Fry on medium heat for 15-20 minutes before adding

Peas – 1 lbs. If frozen, you can steam for a bit to thaw.

Tomatoes – dice, you can use canned or fresh.

Garlic – 5 cloves, chopped. You can fry them for a bit with the onions and peppers if you prefer a less spicy flavor.

Broccoli – Trim stem, steam for 3 minutes. Broccoli cooks much faster than cauliflower. Add it at the end to avoid overcooking it.

Dairy

Cheese – As much as you like. I usually add at least 1 cup of colby jack or cheddar

Sour cream – 1/4 cup. This is a good addition if you add hot sauce

butter – 2 tbsp

Spices DO NOT ADD ALL OF THESE.

Just pick 2 or 3 and experiment with flavors. As a general rule, use a tablespoon, taste and adjust depending on what you like.

Salt

Pepper – to taste

Chinese 5 Spice

Chili powder

Curry powder

Cumin

Turmeric

Coriander

Garlic powder – if you don’t use real garlic

Onion powder – if you don’t use real onions

Hot sauce

Herb de Province

Soy sauce

Worcestershire sauce

Old Bay

Whatever you like

You can make a big pot of this stuff, freeze it and thaw it throughout the week. Stews are great meals for prepping. You can add more starches/cheap ingredients like rice and beans if you are poor and if you’re looking to improve nutrition/lose weight, use more vegetables. It’s a great flexible way to cook convenient meals.